Stock Market Chart Analysis Rising Wedge of S&P 500

The rising wedge pattern, while a potent tool in a trader's arsenal, requires proper confirmation to ensure its validity and to mitigate potential false signals. Confirmation is the trader's safeguard, ensuring that the pattern observed is not just a fleeting formation but a genuine indicator of an impending market move.

The Rising Wedge Pattern Explained With Examples

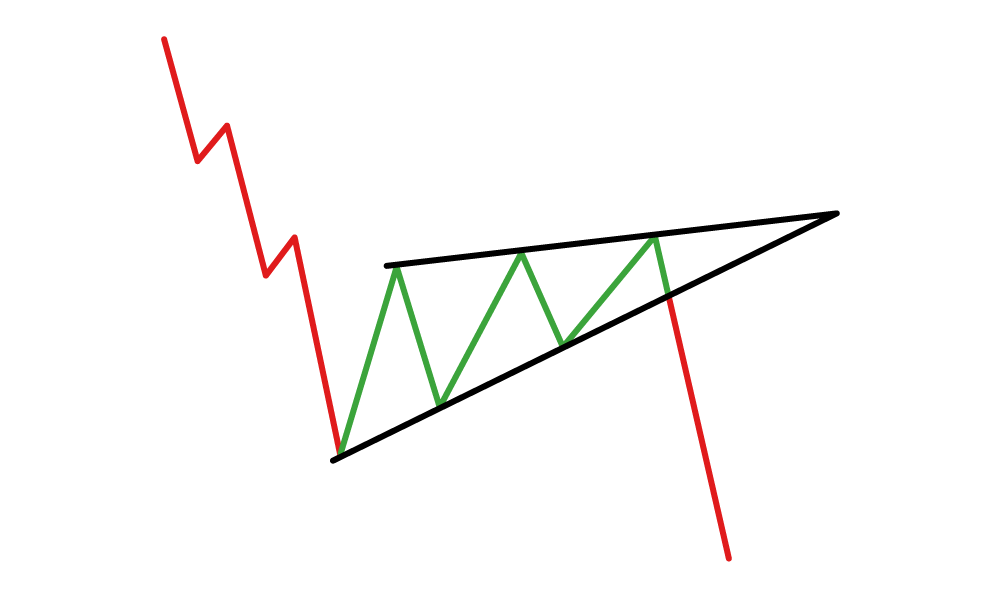

The rising wedge is a bearish chart pattern found at the end of an upward trend in financial markets. It suggests a potential reversal in the trend. It is the opposite of the bullish falling wedge pattern that occurs at the end of a downtrend. Traders recognize the rising wedge as a consolidation phase after a medium to. 19 6

The Rising Wedge Pattern Explained With Examples

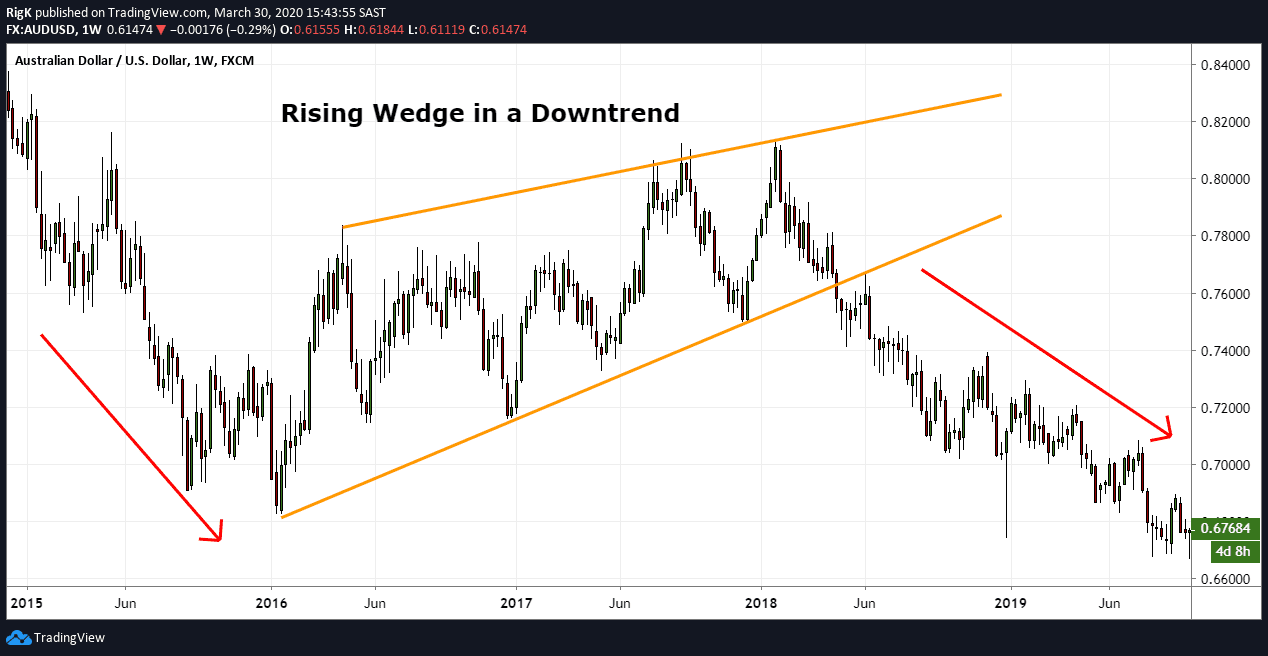

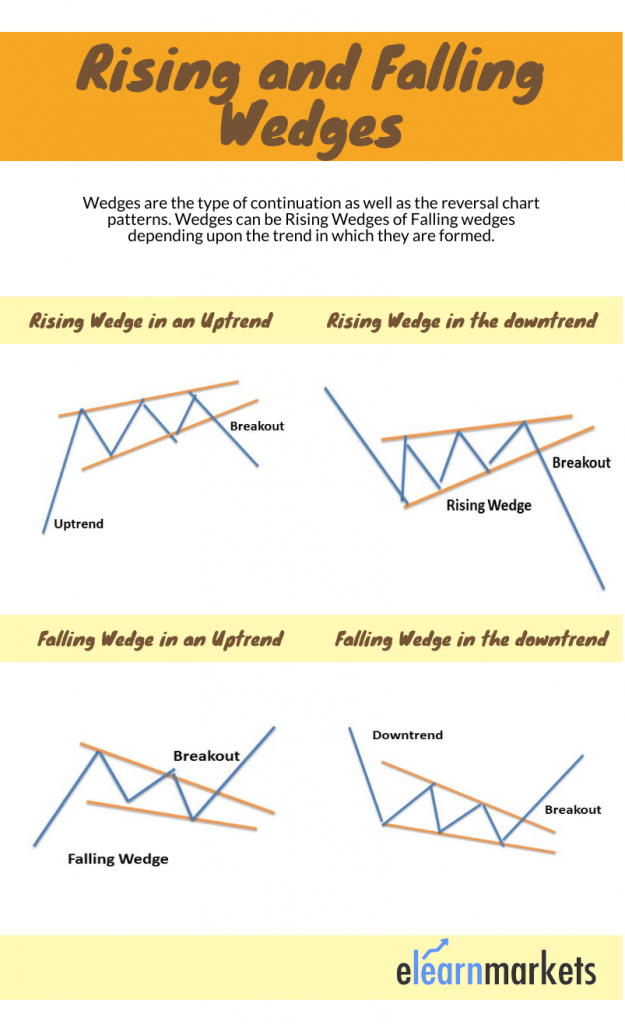

The rising wedge is a technical trading indicator that signals trend reversals or continuations, usually within bear markets. The pattern is also known as "ascending wedge" due to the way it appears on a chart. The ascending wedge pattern can form when the stock is either in an uptrend or a downtrend market.

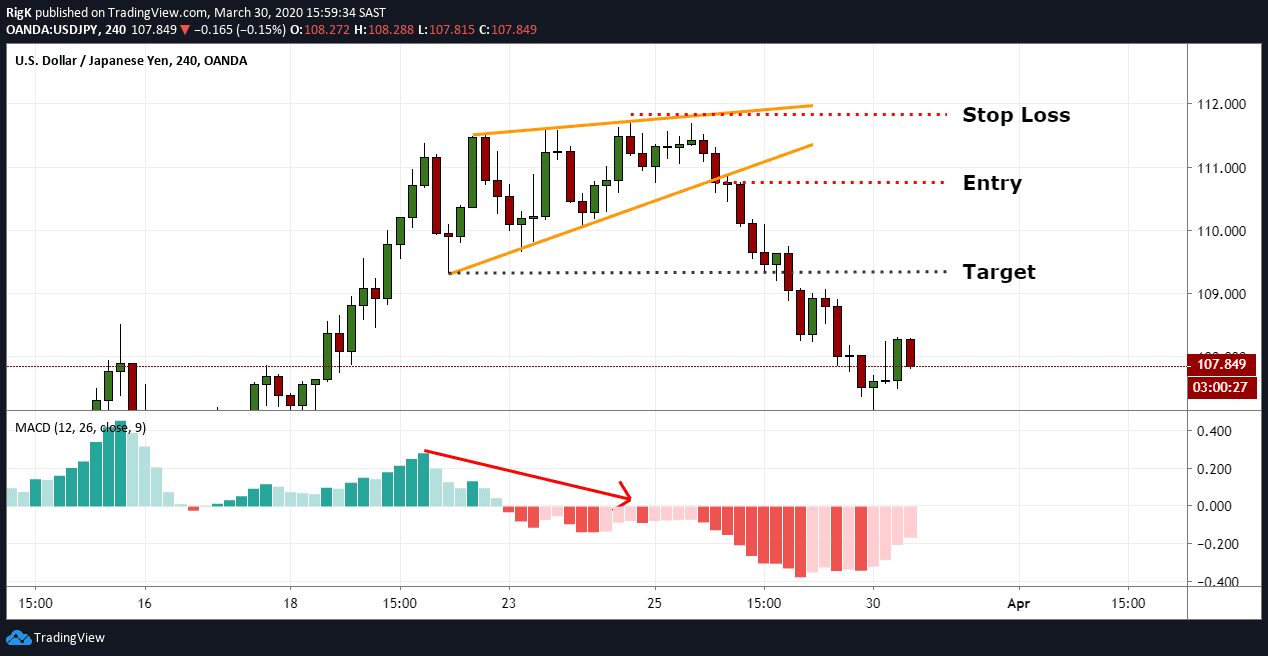

Using the Rising Wedge Pattern in Forex Trading

A rising wedge is a bearish pattern that signals that the market is going to continue downwards , or turn bearish, depending on the previous trend direction. However, some traders choose to regard the rising wedge as a bullish pattern, if the conditions are right.

Wedges Price Pattern

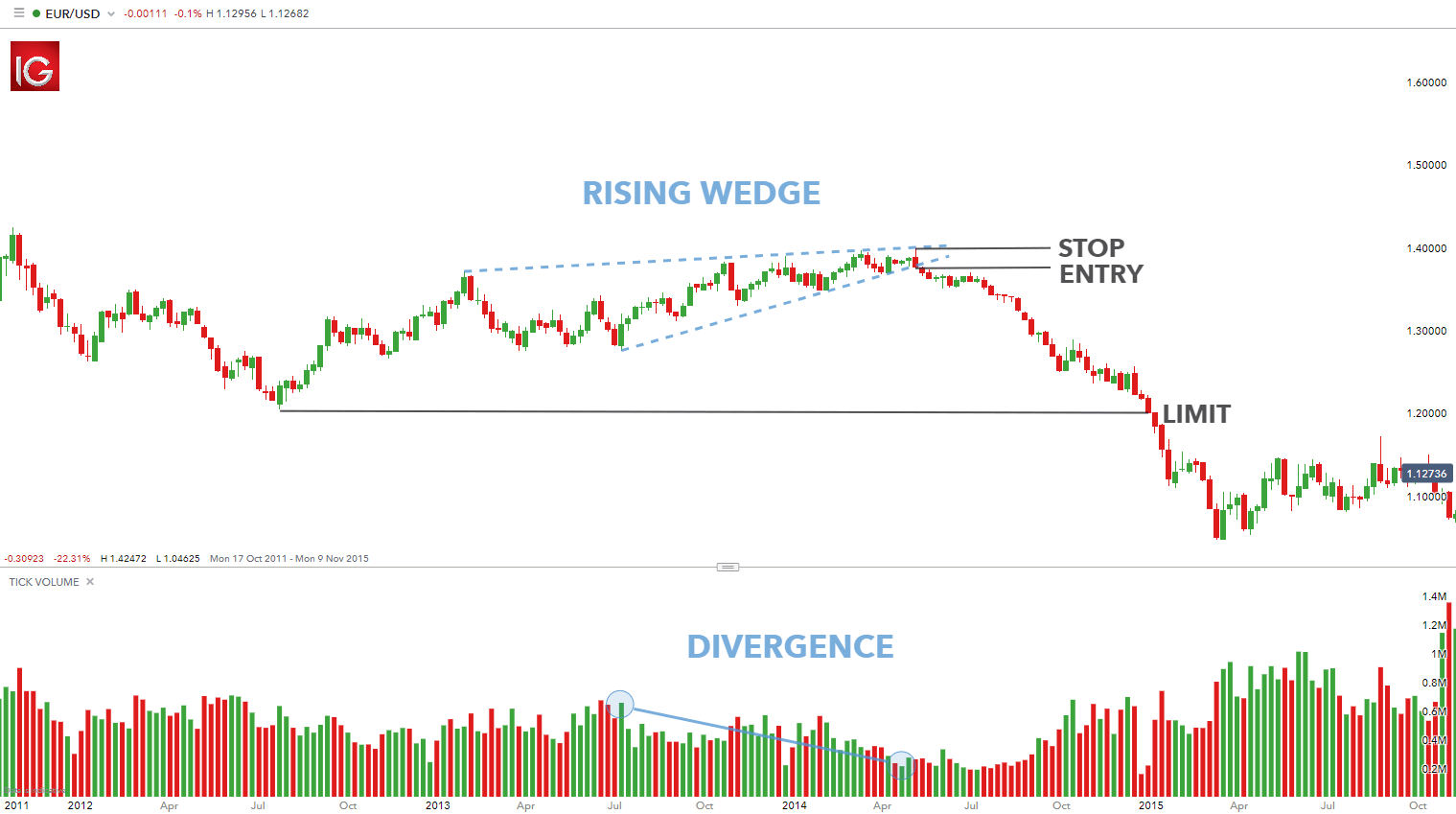

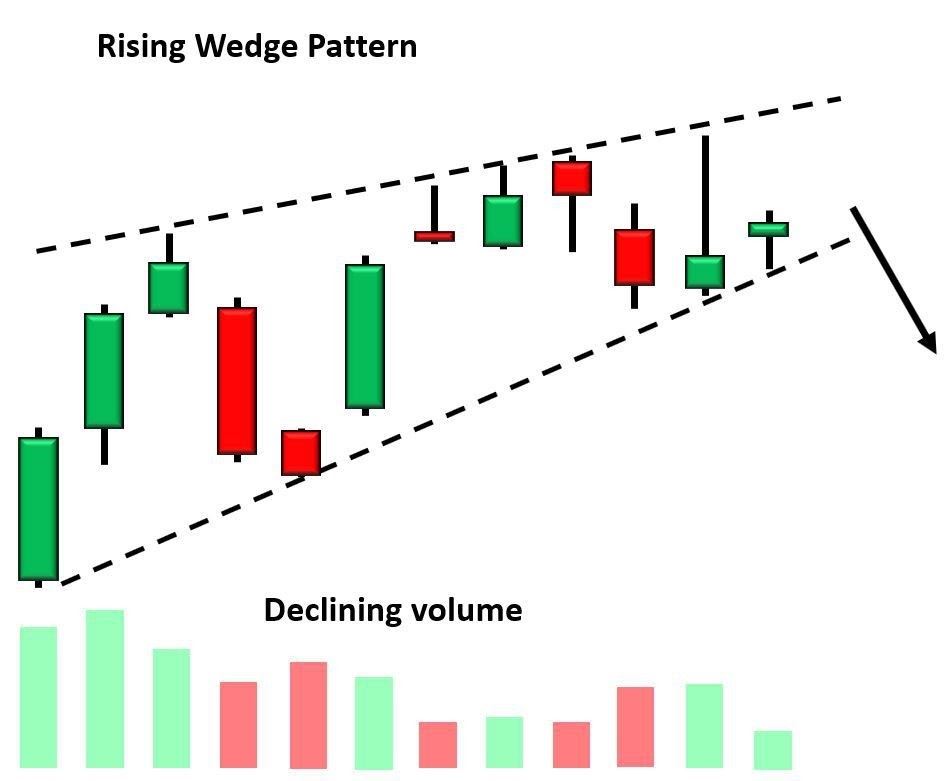

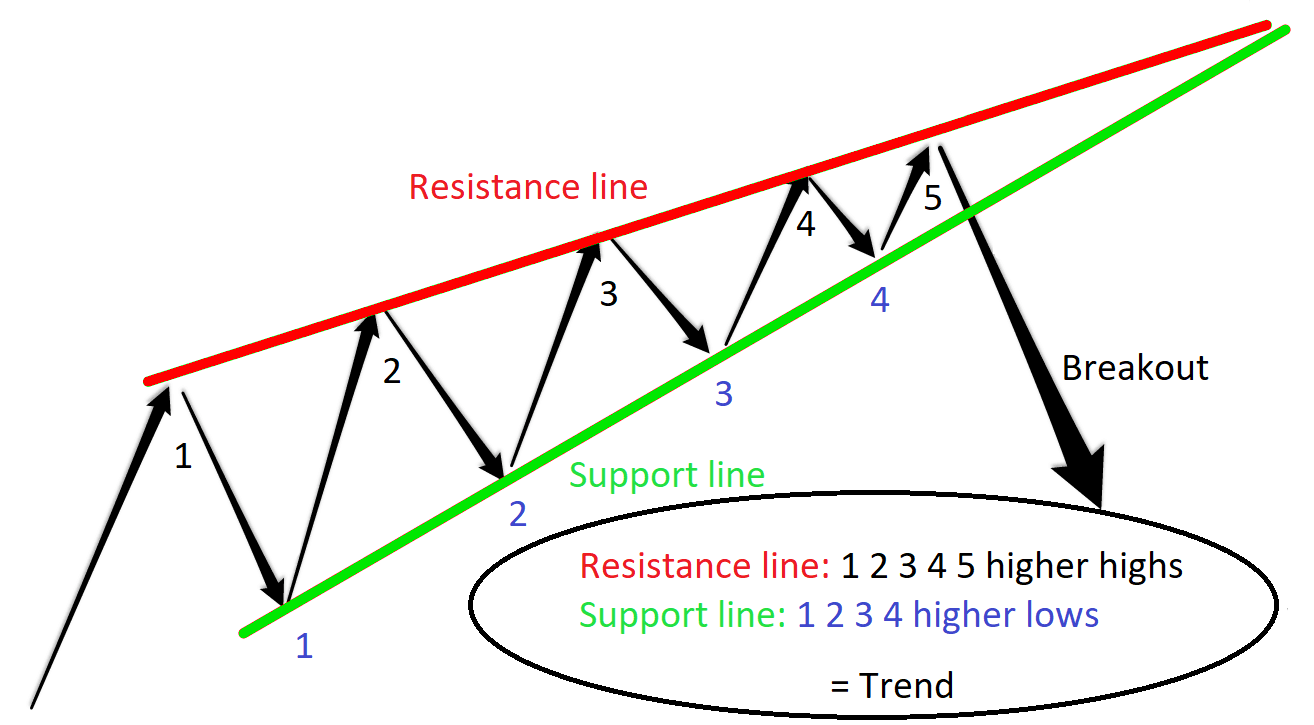

The rising wedge chart pattern is a recognisable price move that's formed when a market consolidates between two converging support and resistance lines. To form a rising wedge, the support and resistance lines both have to point in an upwards direction and the support line has to be steeper than resistance. Like head and shoulders, triangles.

5 Chart Patterns Every Beginner Trader Should Know Brooksy

To make things clear and organized, you are advised to follow the steps below in order to identify and use the rising wedge bearish reversal pattern in trading. Identify an existing trend in a currency pair. Draw support and resistance two trend lines along with the highs and lows of the trend. Wait for a price consolidation and the contraction.

How To Trade With Falling & Rising Wedge Pattern ELM

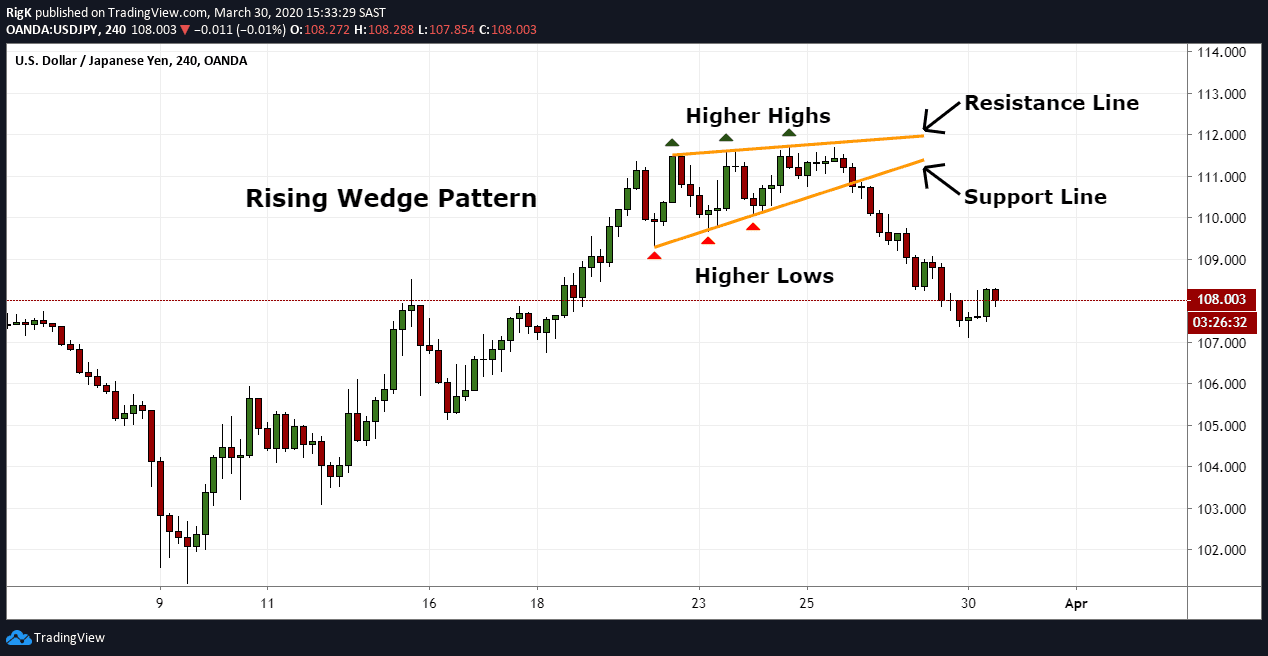

Identifying the rising wedge pattern in an uptrend. A rising wedge in an uptrend is considered a reversal pattern that occurs when the price is making higher highs and higher lows. As the chart below shows, this is identified by a contracting range in prices. The price is confined within two lines which get closer together to create a pattern.

Rising Wedge Pattern Bearish Patterns ThinkMarkets EN

The rising wedge is a technical chart pattern used to identify possible trend reversals. The pattern appears as an upward-sloping price chart featuring two converging trendlines. It is.

Rising Wedge Chart Pattern Best Analysis

April 19, 2023 According to multi-year testing, the rising wedge pattern has a solid 81% success rate in bull markets with an average potential profit of +38%. The ascending wedge is a reliable, accurate pattern, and if used correctly, gives you an edge in trading.

Cool Rising Wedge Pattern Adalah References Blog Ekspor Impor Indonesia

Rising and falling wedges are a technical chart pattern used to predict trend continuations and trend reversals. In many cases, when the market is trending, a wedge pattern will develop on the chart. This wedge could be either a rising wedge pattern or falling wedge pattern.

The Rising Wedge Pattern Explained With Examples

The forex rising wedge (also known as the ascending wedge) pattern is a powerful consolidation price pattern formed when price is bound between two rising trend lines. It is considered a bearish.

Using the Rising Wedge Pattern in Forex Trading

The rising wedge pattern, in particular, stands as a beacon in the sea of market analysis, guiding traders through the ebb and flow of price movements. Known for its distinct shape, this pattern is a key to unlocking understanding of market psychology, pointing to both imminent reversals and possible continuities in price trends..

How To Trade With Falling & Rising Wedge Pattern ELM

Therefore, rising wedge patterns indicate the more likely potential of falling prices after a breakout of the lower trend line. Traders can make bearish trades after the breakout by selling.

Rising Wedge — Chart Patterns — Education — TradingView

A rising wedge pattern consists of a bunch of candlesticks forming a big angular wedge that is increasing price. It is a bullish candlestick pattern that turns bearish when the price breaks out of a wedge. Rising wedge patterns form by connecting at least two to three higher highs and two to three higher lows, becoming trend lines.

Rising Wedge Pattern How to Identify a Selling Opportunity Bybit Learn

A rising wedge is a pattern that forms on a fluctuating chart and is caused by a narrowing amplitude. If you draw lines along with the highs and lows, then the two lines will form an imaginary angle that will narrow over time. Moreover, this angle's inclination must be positive; the resulting corner should be pointing upward, indicating an uptrend.

Trading method Rising Wedge — Cryptomunity.eu

The rising wedge pattern is used in financial markets to identify potential trend reversals. It consists of converging trendlines that slope upward, with the lower trendline rising at a steeper angle than the upper one.